Pakistan's economy is confronted with a severe economic crisis, which is characterized by high level ..

Fiscal and monetary policies are in contradiction with each other which has negative implications fo ..

Pakistan's economy is confronted with a severe economic crisis, which is characterized by high level ..

Pakistan's economy is confronted with a severe economic crisis, which is characterized by high levels of inflation, low economic activity, low foreign reserves, a depreciating currency, and enormous public finance imbalances. The prevailing political uncertainty is further contributing to the problem. The Federal Budget 2023-24 was presented against this challenging macroeconomic backdrop and a co ..

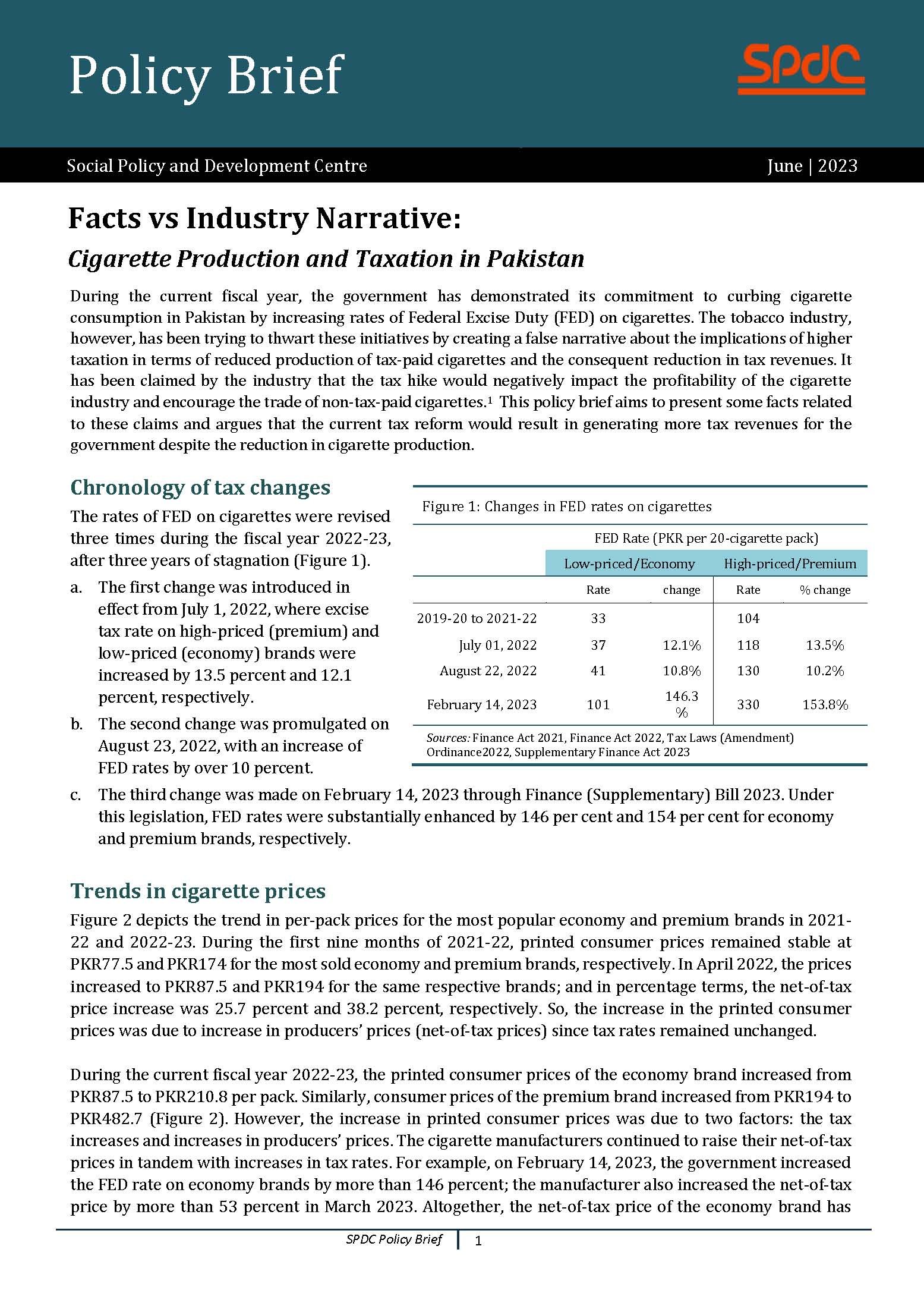

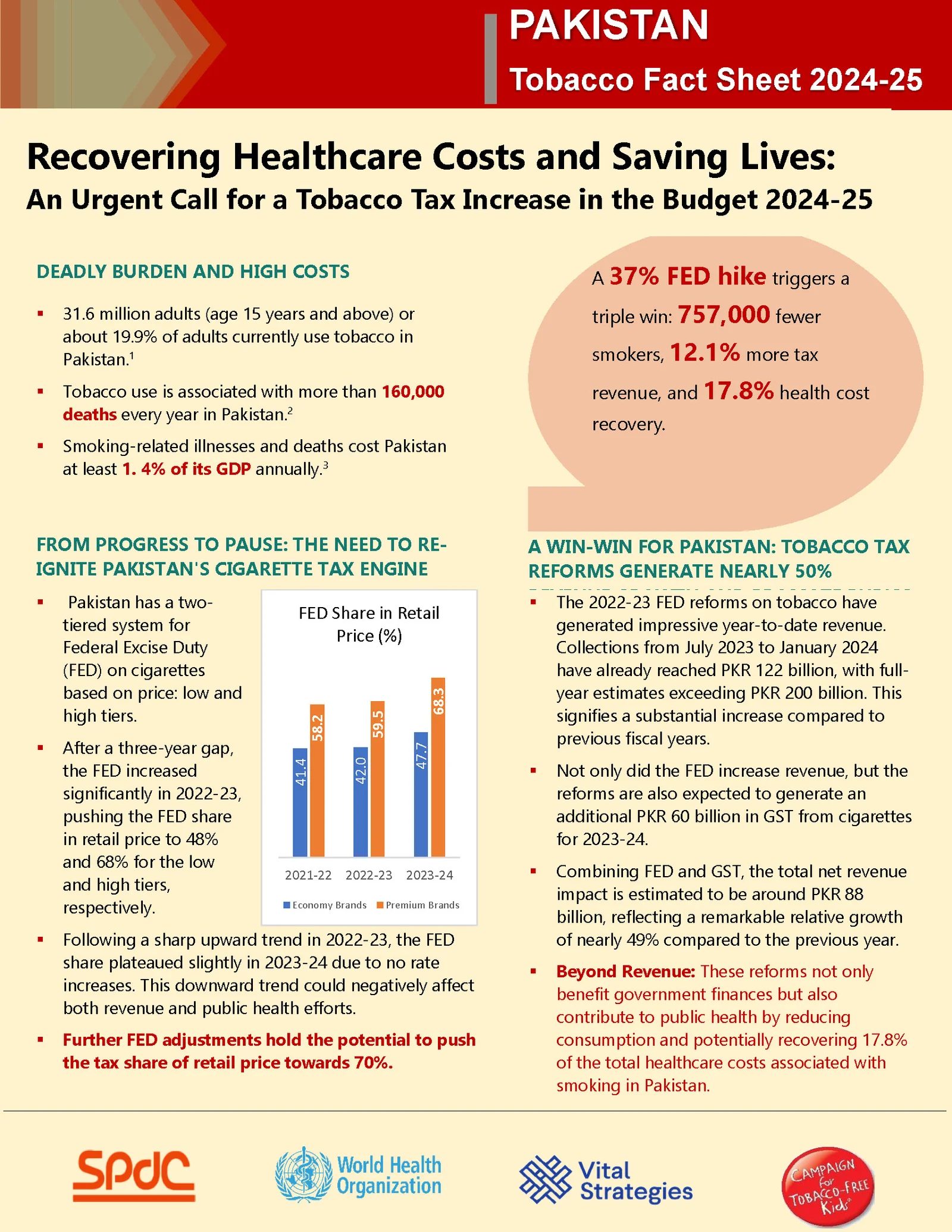

During the current fiscal year, the government has demonstrated its commitment to curbing cigarette consumption in Pakistan by increasing rates of Federal Excise Duty (FED) on cigarettes. ..

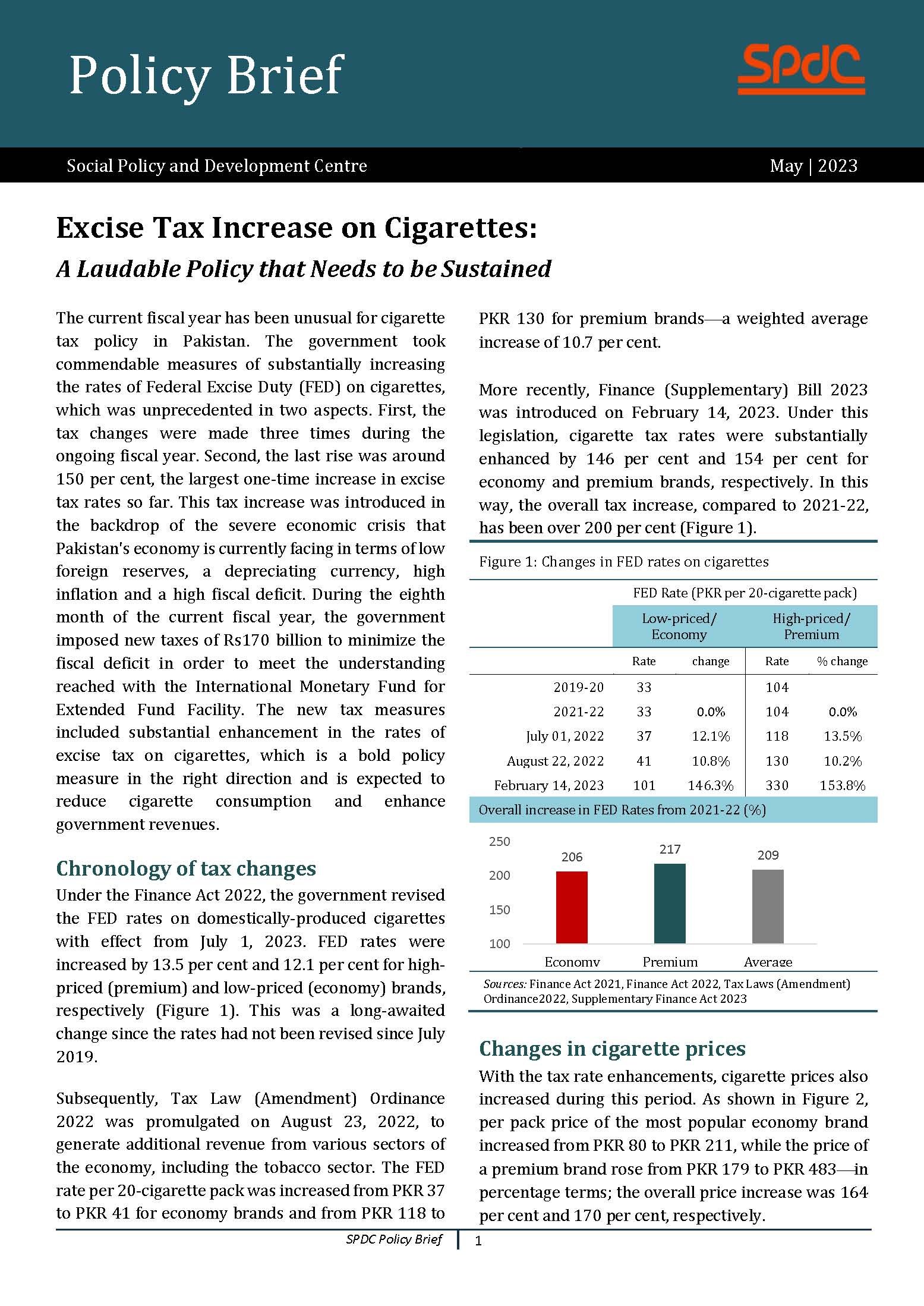

The current fiscal year has been unusual for cigarette tax policy in Pakistan. The government took commendable measures of substantially increasing the rates of Federal Excise Duty (FED) on cigarettes, which was unprecedented in two aspects. First, the tax changes were made three times during the ongoing fiscal year. Second, the last rise was around 150 per cent, the largest one-time increase in e ..

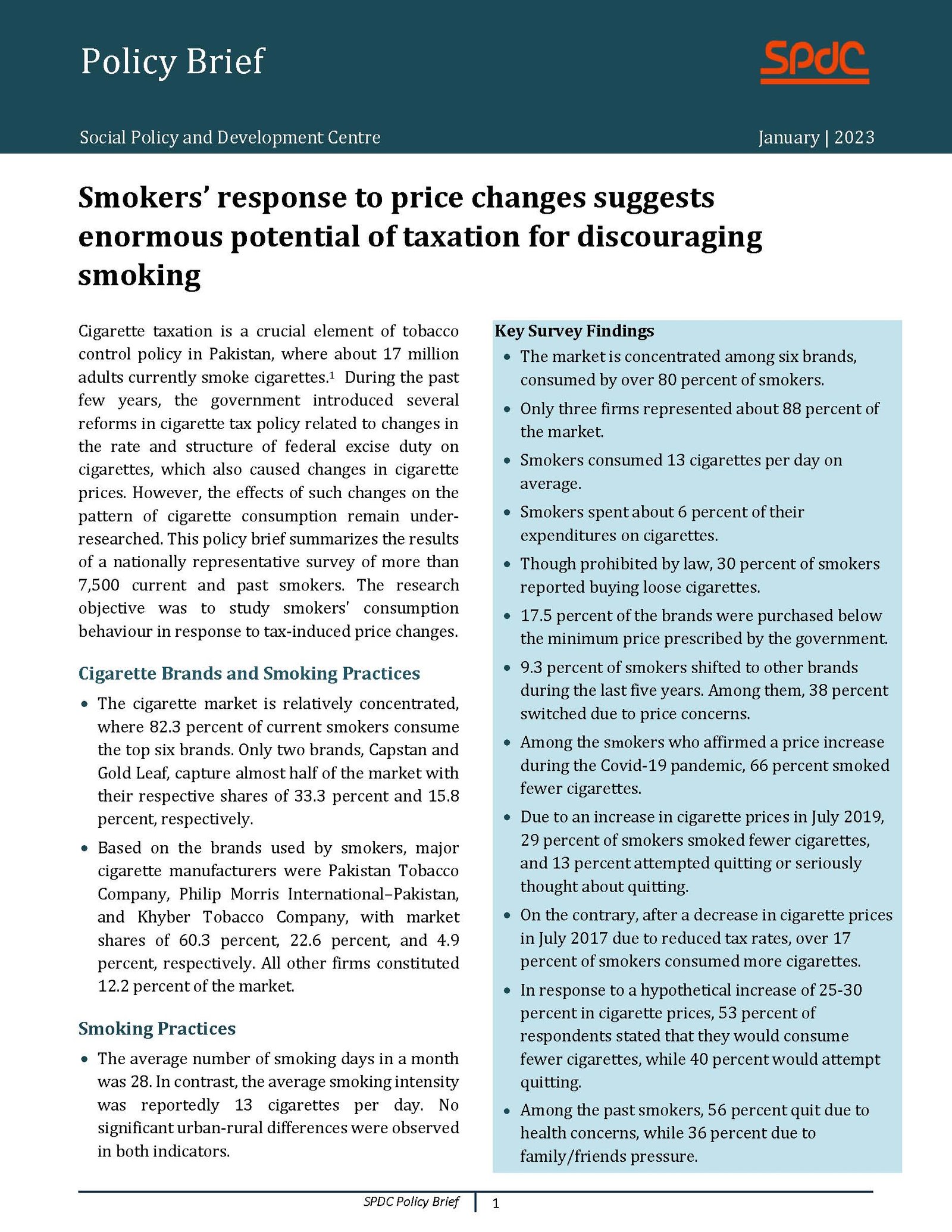

This policy brief summarizes the results of a nationally representative survey of more than 7,500 current and past smokers. The research objective was to study smokers' consumption behaviour in response to tax-induced price changes. ..

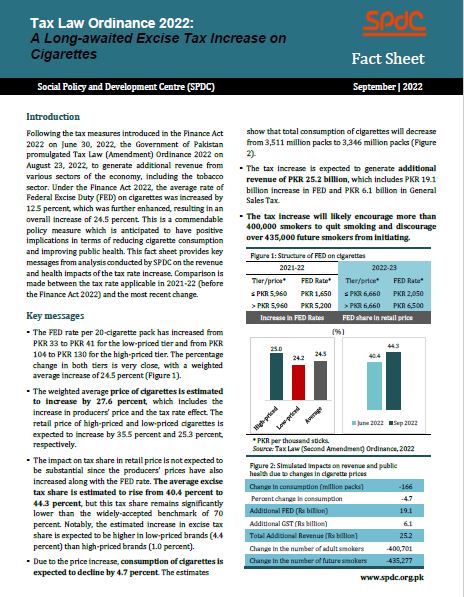

Following the tax measures introduced in the Finance Act 2022 on June 30, 2022, the Government of Pakistan promulgated Tax Law (Amendment) Ordinance 2022 on August 23, 2022, to generate additional revenue from various sectors of the economy, including the tobacco sector. Under the Finance Act 2022, the average rate of Federal Excise Duty (FED) on cigarettes was increased by 12.5 percent, which was ..

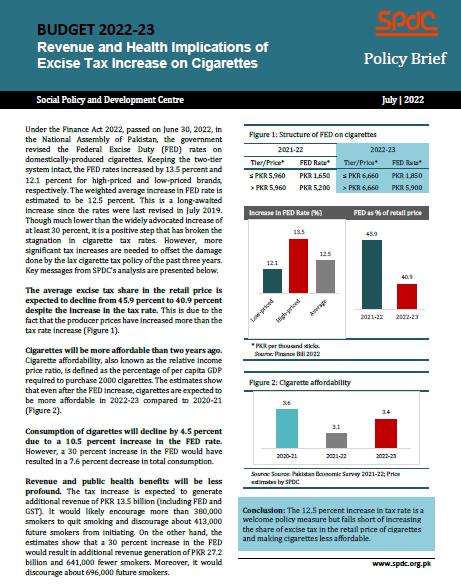

Under the Finance Act 2022, passed on June 30, 2022, in the National Assembly of Pakistan, the government revised the Federal Excise Duty (FED) rates on domestically-produced cigarettes. Keeping the two-tier system intact, the FED rates increased by 13.5 percent and 12.1 percent for high-priced and low-priced brands, respectively. The weighted average increase in FED rate is estimated to be 12.5 p ..

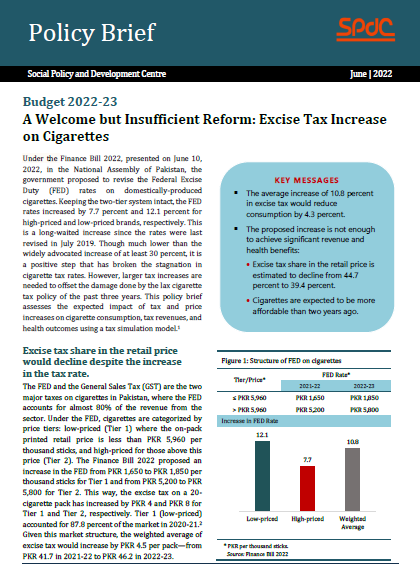

Under the Finance Bill 2022, presented on June 10, 2022, in the National Assembly of Pakistan, the government proposed to revise the Federal Excise Duty (FED) rates on domestically-produced cigarettes. Keeping the two-tier system intact, the FED rates increased by 7.7 percent and 12.1 percent for high-priced and low-priced brands, respectively. This is a long-waited increase since the rates were l ..

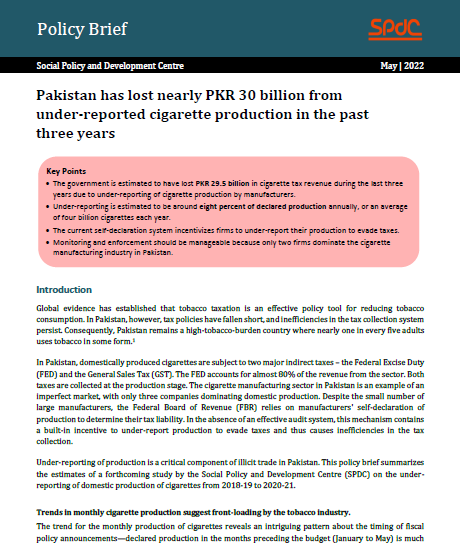

In Pakistan, domestically produced cigarettes are subject to two major indirect taxes – the Federal Excise Duty (FED) and the General Sales Tax (GST). The FED accounts for almost 80% of the revenue from the sector. Both taxes are collected at the production stage. The cigarette manufacturing sector in Pakistan is an example of an imperfect market, with only three companies dominating domestic pr ..

Raising Tobacco Tax Rates to Promote Public Health and Increase Revenue: Policy Options for Budget 2022-23 ..

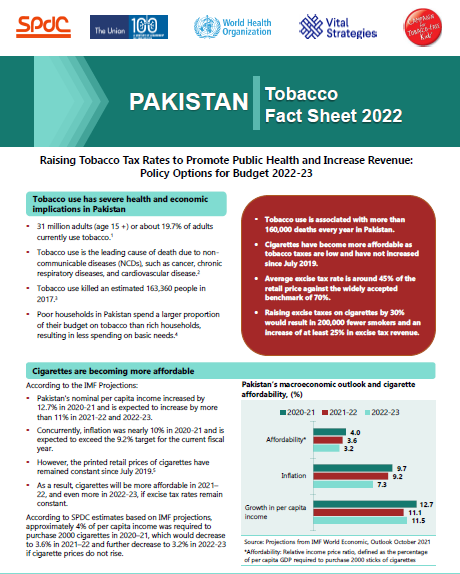

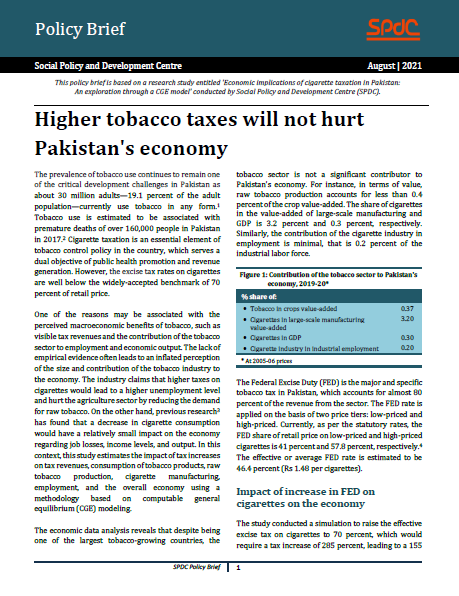

The prevalence of tobacco use continues to remain one of the critical development challenges in Pakistan as about 30 million adults—19.1 percent of the adult population—currently use tobacco in any form. Tobacco use is estimated to be associated with premature deaths of over 160,000 people in Pakistan in 2017.2 Cigarette taxation is an essential element of tobacco control policy in the country ..

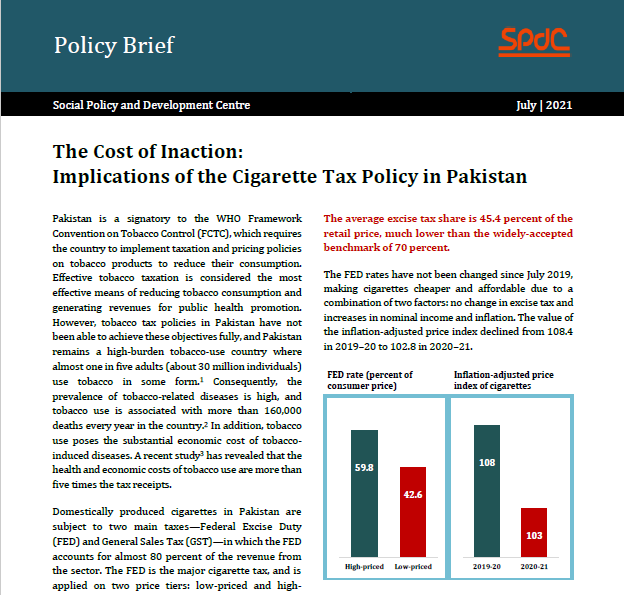

Pakistan is a signatory to the WHO Framework Convention on Tobacco Control (FCTC), which requires the country to implement taxation and pricing policies on tobacco products to reduce their consumption. Effective tobacco taxation is considered the most effective means of reducing tobacco consumption and generating revenues for public health promotion. However, tobacco tax policies in Pakistan have ..

Increasing the price of tobacco products through higher taxation is widely acknowledged as the most effective way to reduce tobacco consumption. Although evidence shows that tobacco taxation does not have a significant impact on the illicit trade of cigarettes1, a common argument of the cigarette industry in Pakistan is that higher taxes drive illicit trade. The industry claims that smokers seek o ..

..

Tobacco taxation is widely acknowledged as a robust policy instrument to scale back tobacco consumption. Effective and optimal tobacco taxation can serve the dual objective of public health promotion and revenue generation. The effectiveness of this tool, however, depends heavily on the mechanisms of tax collection. Read more... ..

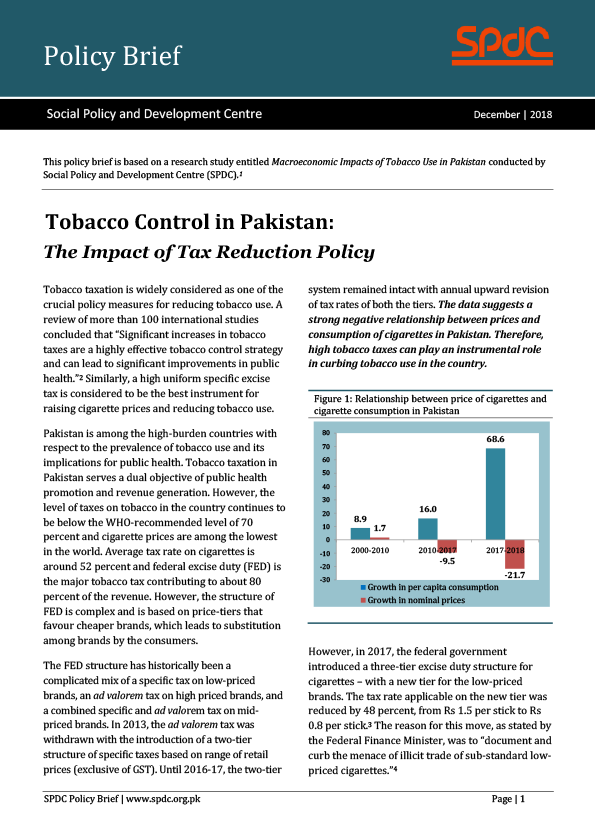

Tobacco Control in Pakistan: The Impact of Tax Reduction Policy ..

Empowering Local Government – The Road to Inclusive and Sustainable Development ..

Fiscal Implications of 7th NFC Award ..

Agenda for Devolved Tax Collection ..

A Reflection on the State of Economy and Federal Budget 2018-19 ..

A Reflection on the State of Economy and Federal Budget 2017-18 ..

Key Issues in the State of Economy ..

Social Impact of the Security Crisis ..

The Elimination of Textile Quotas and Pakistan-EU Trade, Policy Brief, April 2007 ..

Higher Taxes Needed to Make Cigarettes Less Affordable and Increase Revenue ..

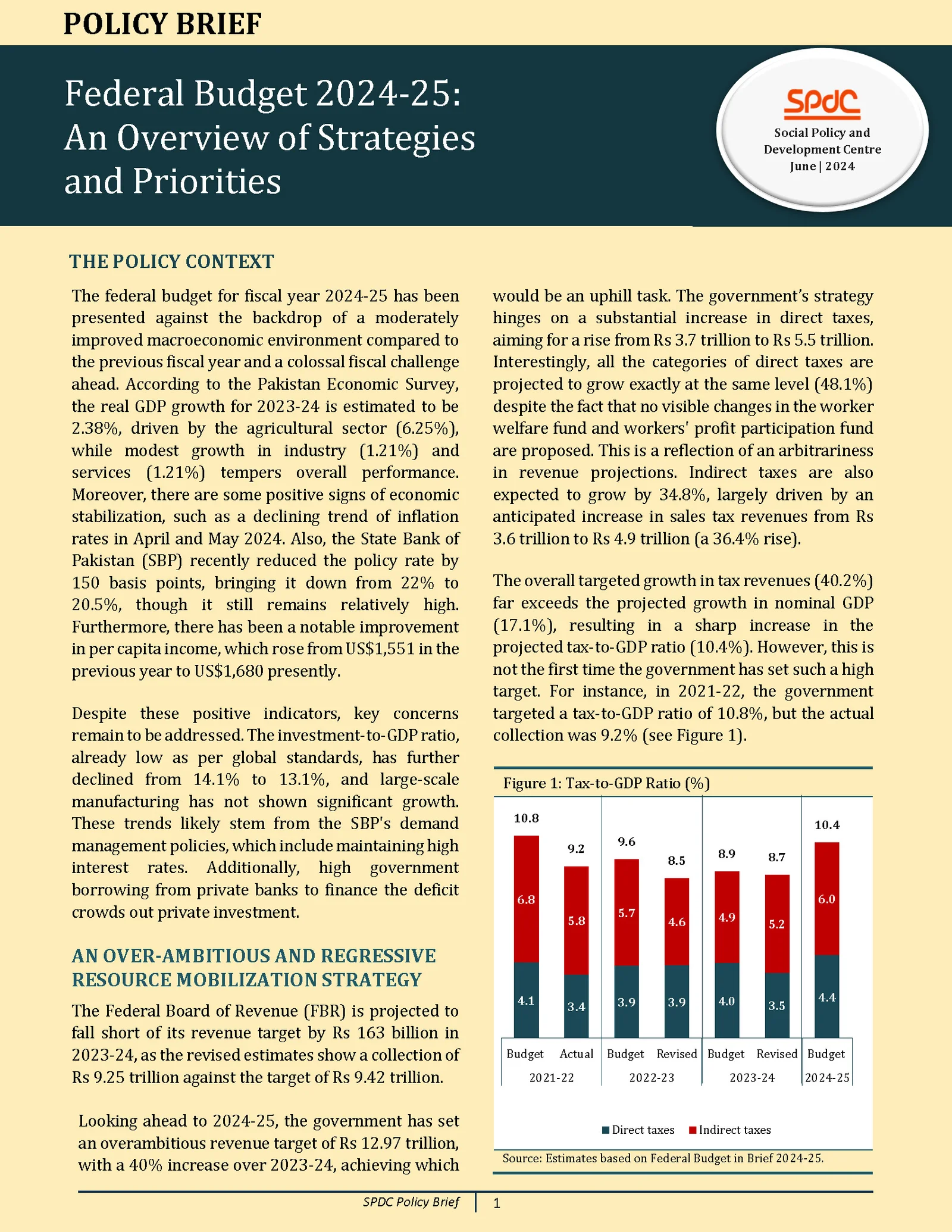

The federal budget for fiscal year 2024-25 has been presented against the backdrop of a moderately improved macroeconomic environment compared to the previous fiscal year and a colossal fiscal challenge ahead. ..

In response to public health concerns surrounding high smoking prevalence, the Pakistani government enacted a substantial increase in the Federal Excise Duty (FED) on cigarettes during the fiscal year 2022-23. This policy intervention, with the most notable rise of around 150 percent occurring in February 2023, resulted in a corresponding increase in cigarette prices. ..

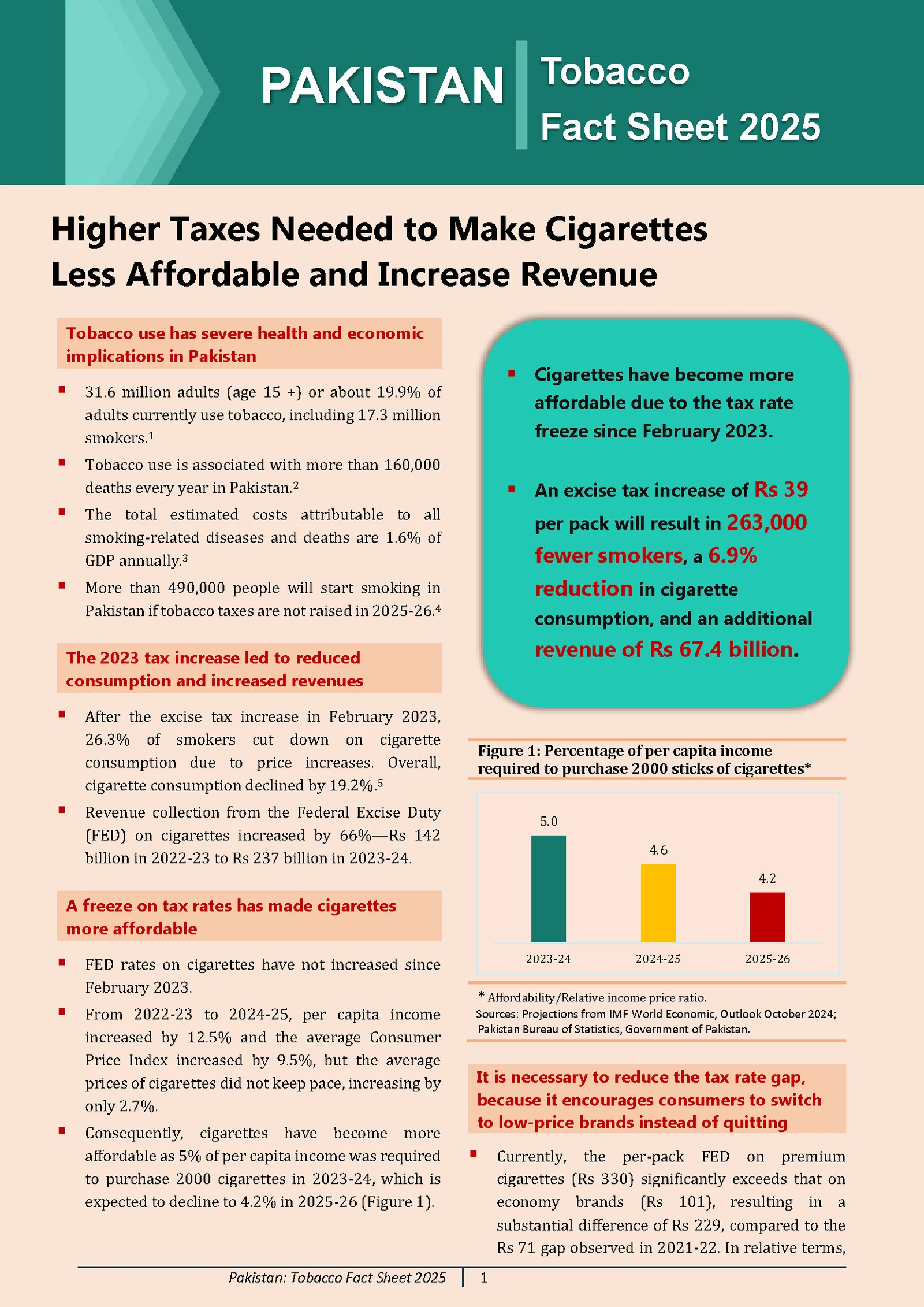

Even though the Government of Pakistan was under tremendous pressure to increase taxes in various sectors to generate additional revenue for financing the fiscal deficit in the fiscal year 2024-25, it surprisingly spared the cigarette industry from any tax hike. The Finance Act 2024 passed by the National Assembly on June 28, 2024 remained silent on enhancing the rate of Federal Excise Duty (FED) ..

The illicit tobacco trade is a contentious issue in Pakistan, with the government concerned about lost revenue due to tax evasion and the industry arguing that high taxes lead to increased illicit due to lax tax administration. This debate has recently intensified, with the industry propagating that the tax hike in February 2023 has significantly fueled illicit trade. ..

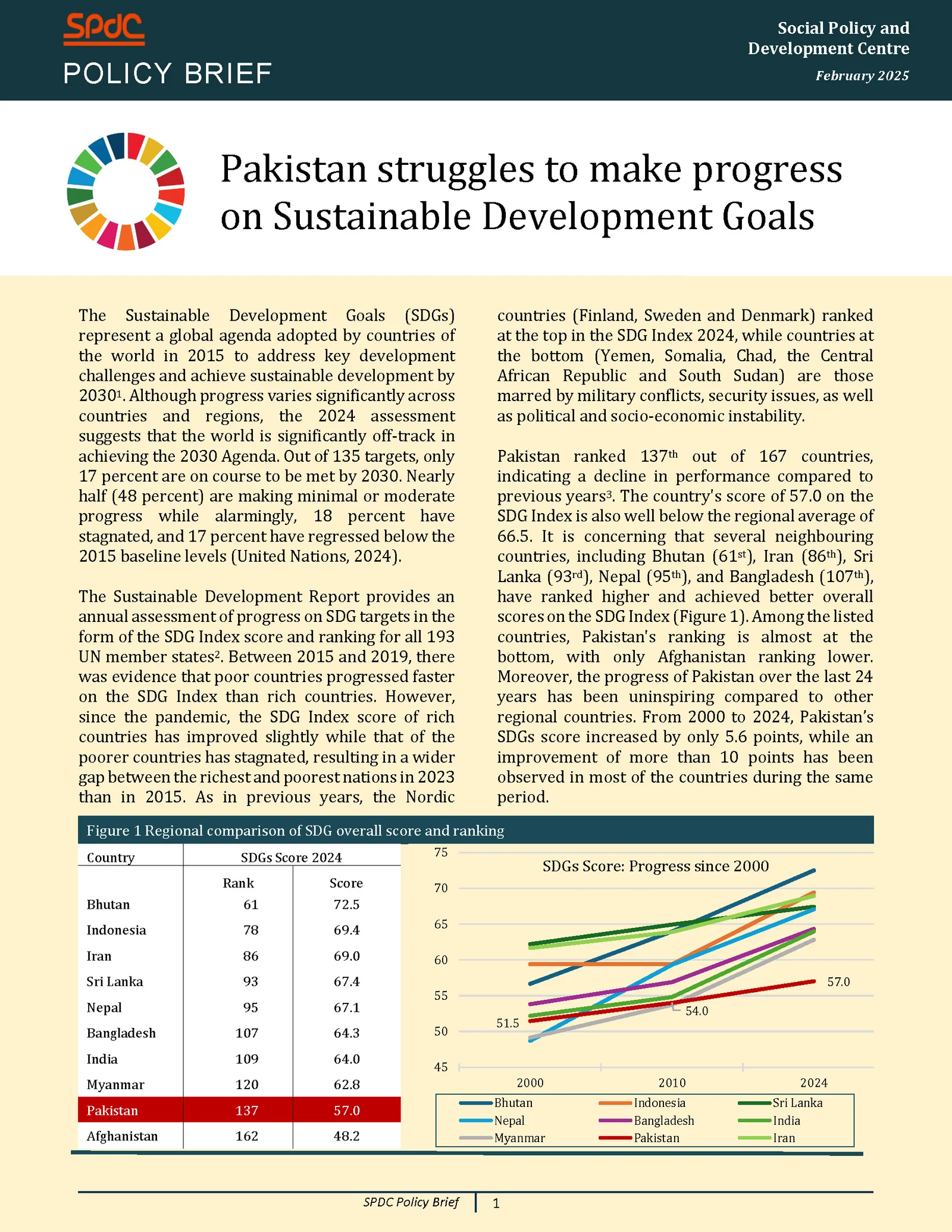

The Sustainable Development Goals (SDGs) represent a global agenda adopted by countries of the world in 2015 to address key development challenges and achieve sustainable development by 2030. Although progress varies significantly across countries and regions, the 2024 assessment suggests that the world is significantly off-track in achieving the 2030 Agenda. Out of 135 targets, only 17 percent ar ..

Higher Taxes Needed to Make Cigarettes Less Affordable and Increase Revenue ..